🎧 Listen to this article

Table of Contents

- Introduction: Securing Your Legacy in Stafford, Virginia

- What is a Living Trust? A Clear Explanation for Stafford Residents

- Defining the Key Terms

- The Power of a Revocable Living Trust (Rev Living Trust)

- Living Trust vs. Will: The Critical Differences for Your Virginia Estate Plan

- The Probate Question: How to Avoid Probate in Stafford VA

- Privacy and Control

- Planning for Incapacity

- Top 5 Benefits of a Living Trust for Stafford, VA Families

- 1. Seamlessly Avoid Probate

- 2. Maintain Family Privacy

- 3. Protect Against Incapacity

- 4. Greater Control Over Asset Distribution

- 5. Minimize Potential for Family Disputes

- Who Needs a Living Trust in Stafford, VA?

- You should consider a living trust if you are a Stafford resident who:

- How to Create and Fund Your Stafford VA Living Trust

- Step 1: Partner with an Experienced Estate Planning Attorney in Stafford VA

- Step 2: Drafting Your Trust Document

- Step 3: Funding Your Trust (The Critical Step)

- Conclusion: Take the Next Step in Protecting Your Family’s Future

Introduction: Securing Your Legacy in Stafford, Virginia

Imagine you’ve spent a lifetime working hard, raising a family, and building a comfortable life here in Stafford, Virginia. You’ve accumulated assets—a home, savings, investments—that you want to pass on to your children and grandchildren. Now, imagine your loved ones, already grieving, having to navigate a complex, time-consuming, and surprisingly public court process just to receive the inheritance you intended for them.

This scenario is the reality for many families who rely solely on a traditional will. The often-overlooked challenge is probate, and in Stafford County, it can be a lengthy and costly legal procedure. All of your will’s details, from your assets to who gets what, become a public record, open for anyone to see.

Fortunately, there is a powerful tool for modern estate planning in Stafford VA that offers a better way: a revocable living trust. More than just a will, a living trust provides a comprehensive strategy to protect your family, your assets, and your privacy. This guide will explain what a living trust is, how it differs from a will, and why it might be the best choice for protecting your Stafford family’s future.

What is a Living Trust? A Clear Explanation for Stafford Residents

At its core, a living trust is a legal tool designed to hold your assets. Think of it as a secure container you create to manage your property during your lifetime and to ensure a seamless transfer to your loved ones after you’re gone.

Defining the Key Terms

Understanding a trust is easier when you know the key players:

- Grantor: This is you—the person who creates the trust and transfers assets into it.

- Trustee: This is the person or institution responsible for managing the assets held in the trust. While you are alive and able, you will almost always act as your own trustee.

- Successor Trustee: You will name a trusted person (like an adult child, a relative, or a professional) to take over as trustee when you pass away or become unable to manage your affairs.

- Beneficiary: These are the loved ones—your spouse, children, or even charities—who will receive the assets from the trust.

The Power of a Revocable Living Trust (Rev Living Trust)

The most common type of trust for estate planning is a revocable living trust. The word “revocable” is key; it means you maintain complete control. You can change the terms, add or remove assets, or even cancel the entire trust at any time for any reason, as long as you are able. This flexibility is crucial, as your life and wishes may change over time. It provides a secure framework that can adapt with your family’s journey in Stafford.

Living Trust vs. Will: The Critical Differences for Your Virginia Estate Plan

While both wills and trusts outline your wishes for asset distribution, they function very differently. Deciding in Virginia which one should I choose, a will or a trust, depends on your goals, but the differences are significant.

| Feature | Last Will and Testament | Revocable Living Trust |

|---|---|---|

| Probate Process | Required. Must go through the Stafford County Circuit Court. | Avoided. Assets are distributed privately by the successor trustee. |

| Privacy | Public Record. Your will, assets, and heirs are public. | Private. The terms of your trust remain a confidential family matter. |

| Incapacity Planning | Inactive. Only takes effect after your death. | Active. Your successor trustee can manage your assets if you become incapacitated. |

| Effectiveness | Only upon death. | Effective immediately upon creation and funding. |

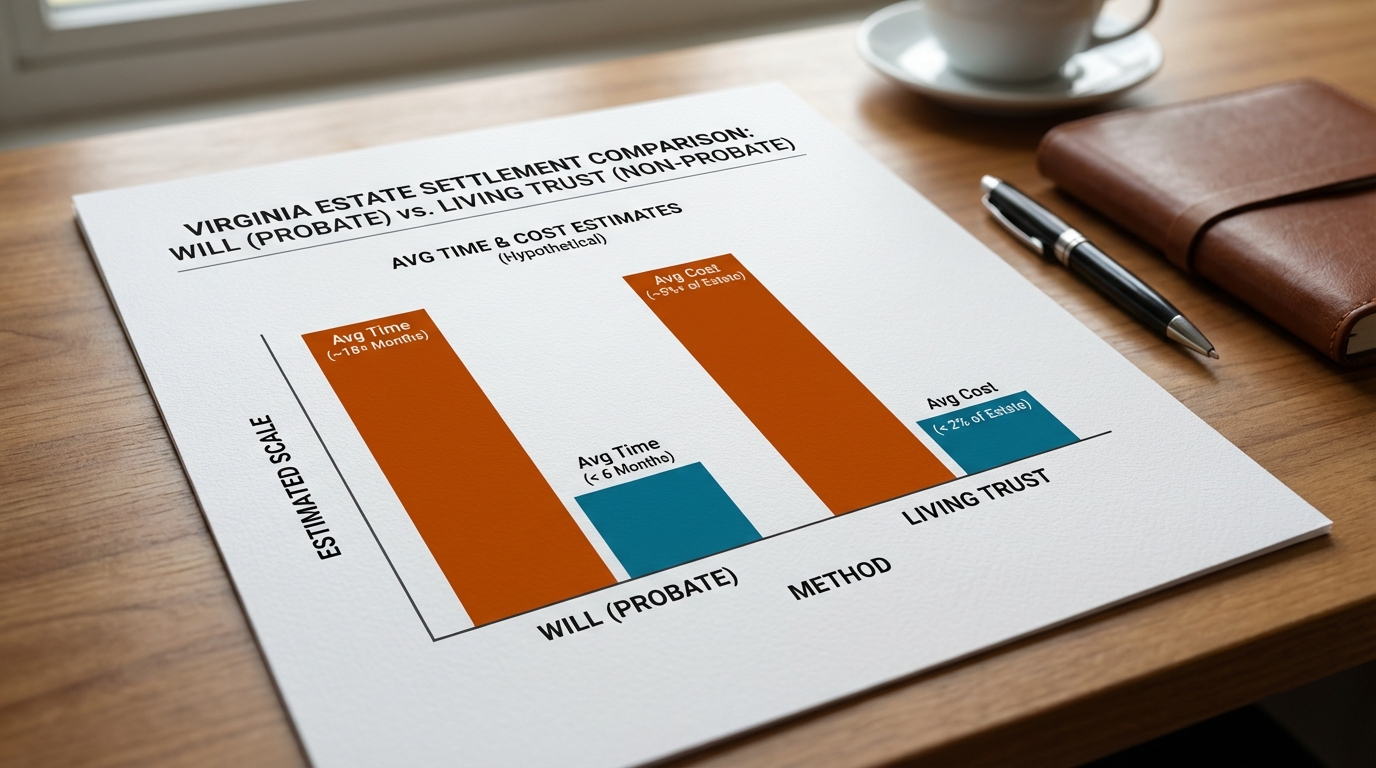

The Probate Question: How to Avoid Probate in Stafford VA

The single most significant advantage of a living trust is its ability to avoid probate. A will is essentially a set of instructions for the probate court. Your executor must file the will with the Stafford County Circuit Court, kicking off a formal legal process.

With a living trust, the assets are owned by the trust, not you as an individual. Upon your death, your chosen successor trustee steps in and distributes the assets directly to your beneficiaries according to your instructions, completely bypassing the court system. This is one of the most effective ways property can escape probate in Virginia.

Privacy and Control

Because a will must be probated, it becomes a public document. Anyone can go to the courthouse and see a list of your assets, your debts, and who you chose to inherit from you. This can lead to unwanted solicitations for your heirs and potential family disputes. A living trust ensures that your entire estate plan remains a private family matter.

Planning for Incapacity

A will only becomes effective upon your death. It offers no protection if you become ill or injured and are unable to manage your own financial affairs. In that situation, your family might have to petition the court to appoint a conservator to handle your finances—a costly and intrusive public process.

A living trust, however, provides a clear plan for incapacity. If you become unable to manage your affairs, the successor trustee you named can immediately and privately step in to pay bills and manage your assets, avoiding the need for court intervention.

Top 5 Benefits of a Living Trust for Stafford, VA Families

1. Seamlessly Avoid Probate

By avoiding the Stafford County probate process, you save your family significant time, stress, and money. Assets can often be distributed to your heirs much faster than with a will, avoiding court delays and administrative costs.

2. Maintain Family Privacy

A trust keeps your financial affairs confidential. Your assets, their value, and your beneficiaries’ identities are not exposed in public records, protecting your family from unsolicited contact and reducing the risk of challenges from disgruntled relatives.

3. Protect Against Incapacity

A rev living trust is a cornerstone of effective incapacity planning. It provides a clear, pre-determined plan for who will manage your finances if you are unable to, ensuring your bills are paid and your assets are managed without the need for a court-appointed conservatorship.

4. Greater Control Over Asset Distribution

A trust offers far more control than a will. You can set specific conditions for inheritance, such as distributing funds to a minor child only after they reach a certain age or achieve an educational milestone. This is also essential for providing for a beneficiary with special needs without jeopardizing their eligibility for government benefits.

5. Minimize Potential for Family Disputes

Because the process is private and clearly laid out, a living trust can significantly reduce the likelihood of family conflicts. Since it is not a public court proceeding, there is less opportunity for contests and disagreements that can unfortunately tarnish a family’s legacy.

Who Needs a Living Trust in Stafford, VA?

There is a common misconception that trusts are only for the ultra-wealthy. In reality, many Stafford families can benefit from a living trust, particularly if they want to make the process of inheritance as smooth as possible for their loved ones.

You should consider a living trust if you are a Stafford resident who:

- Owns real estate: Any Stafford VA homeowner can benefit immensely, as a trust avoids the probate process for your most valuable asset.

- Has minor children or grandchildren: A trust allows you to appoint a trustee to manage their inheritance until they are mature enough to handle it themselves.

- Wants to keep their family’s inheritance private: If you prefer your financial affairs not to be a public record, a trust is the ideal solution.

- Has a blended family: A trust can provide clear, indisputable instructions for distributing assets among children from different relationships.

- Wishes to make the process as easy as possible for their loved ones: Ultimately, a trust is an act of love, simplifying a difficult time for your family. A trust is one of several documents that are essential for a complete estate plan.

How to Create and Fund Your Stafford VA Living Trust

Creating a living trust involves more than just filling out a form. It’s a precise legal process that requires careful attention to detail.

Step 1: Partner with an Experienced Estate Planning Attorney in Stafford VA

DIY documents or online templates can be risky, as they often fail to account for the specifics of Virginia law and your unique family situation. Working with qualified estate planning attorneys in VA ensures your trust is legally sound, properly drafted, and will function as you intend.

Step 2: Drafting Your Trust Document

Your attorney will work with you to outline your wishes. This includes naming your successor trustee and beneficiaries, and specifying how and when you want your assets distributed. This is also when you would discuss other considerations, like the tax considerations of a revocable trust versus an irrevocable trust in Virginia.

Step 3: Funding Your Trust (The Critical Step)

A trust only controls the assets that are legally transferred into its name. This critical step is called “funding the trust.” It involves re-titling assets like your home, bank accounts, and investment accounts from your individual name to the name of your trust. An empty trust document does nothing to avoid probate.

Conclusion: Take the Next Step in Protecting Your Family’s Future

Relying on a will alone can leave your Stafford family facing the public, costly, and stressful process of probate. A revocable living trust offers a superior alternative, providing comprehensive protection that goes far beyond a simple will.

By choosing a living trust, you ensure the seamless avoidance of probate, maintain your family’s privacy, plan for potential incapacity, and retain complete control over your legacy. It is a proactive and thoughtful act of care for the people you love most.

Ready to explore the benefits of a living trust for your Stafford VA family? Contact our experienced estate planning team for a personalized consultation today.